The market analysts are not expecting a near-term interest rate cut in the United States, but it is believed it may come later this year[1]. For most of 2023, the US economy experienced growth well beyond expectations. Although the pace of growth is slowing, it is projected to remain positive in 2024. The growth rate of US Gross Domestic Product (GDP) in the coming quarters will be below its potential level suggested by some of the analysis. Slower growth below the trend is expected to contribute to a gradual easing of inflationary pressures, allowing the Federal Reserve to begin loosening monetary policy. In this context, investment-grade bond funds are gaining attention from investors.

The Advantages of Investment-Grade Bond Funds:

1. Strategic Investment Amid an Intereste Rate-Cutting Cycle

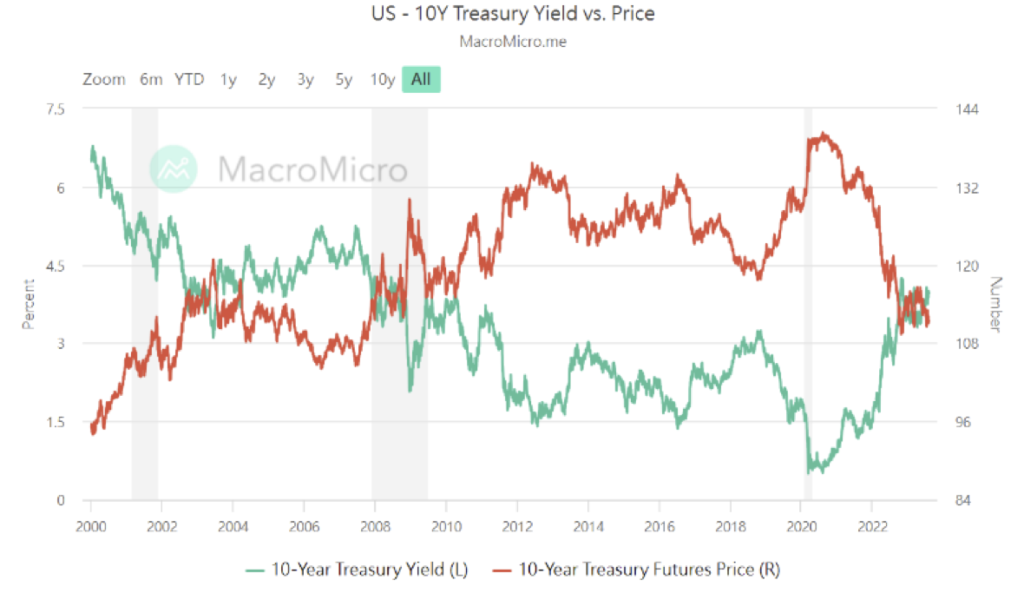

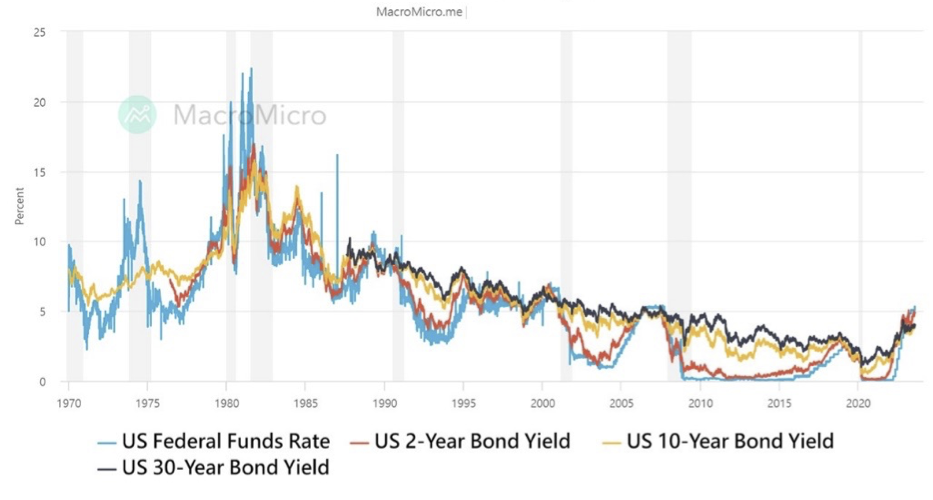

As the US inflation rate hovers around 3%, nearing the government’s target of 2%, market expectations point towards the end of the current interest rate hike cycle. Lower market interest rates generally lead to rising bond prices due to their inverse relationship. If the US enters an interest rate-cutting cycle, investment-grade bond prices could rise. The US Federal Reserve’s decision to pause rate hikes for four consecutive months in January 2024 displays confidence in managing inflation while exercising caution in lowering interest rates[2]. Consequently, investment-grade bond funds emerge as a viable option for investors during this period.

2. A safe Harbor Admidst Market Recession and Uncertainty

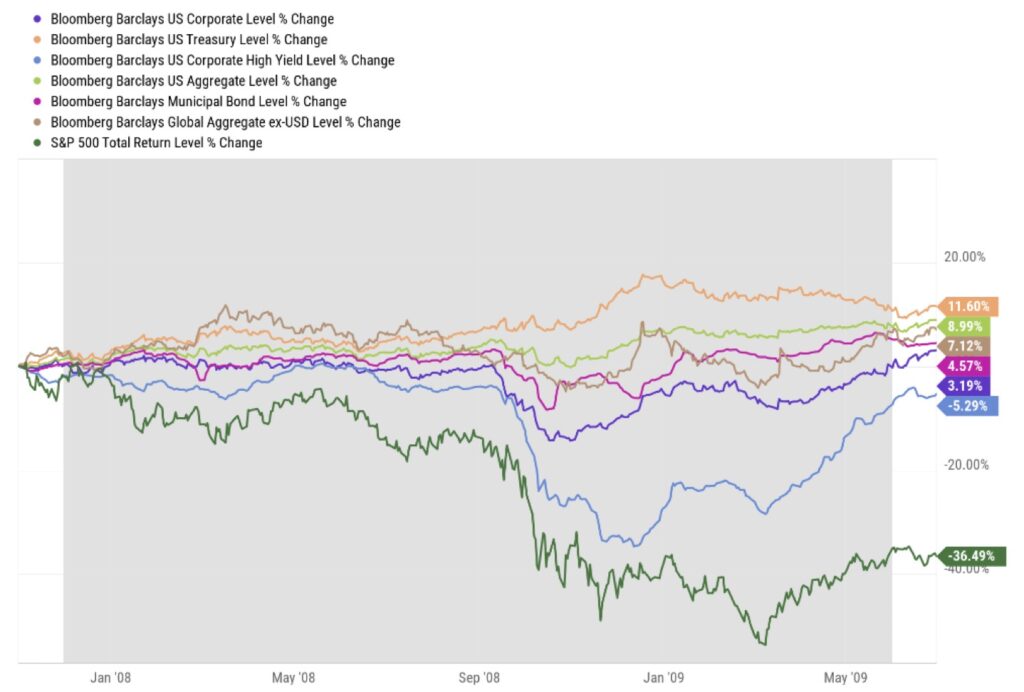

The banking crisis in March 2023 had a significant impact on market sentiment, and the World Bank has warned of potential global economic downturns later this year[4]. In such times, investors tend to shift towards more conservative investments. Historical data indicates that bonds have performed well during recessions or bear markets, as central banks, including the Federal Reserve, often cut interest rates to stimulate market growth. This strategy could lead to positive returns and outperformance compared to equities during recessionary periods. Investment-grade bonds, with a minimum rating of ‘BBB-‘, are generally considered safer than lower-quality bonds, providing a safe harbor for investors.

Moreover, investment-grade bonds, with a minimum rating of ‘BBB-‘, are generally considered safer than bonds of lower quality. Some investment-grade bond funds in the market hold bonds with a minimum ‘A-‘ rating, primarily comprising government and corporate bonds.

3. The allure of Potentially Higher Returns

At present, some investment-grade bond funds are offering attractive yields that potentially exceed 6%[6]. This can be enticing for long-term investors seeking higher bond yields. Despite the possibility of a slight rise in benchmark interest rates by the Fed, the current higher bond yields provide some cushioning effect against a decline in bond prices.

Conclusion:

In the current market landscape, investment-grade bond funds present a compelling option for investors seeking stable, medium to long-term investments. They offer strategic advantages during an interest rate-cutting cycle, serve as a safe harbor amidst market recessions and uncertainties, and provide the allure of potentially higher returns. To understand this asset class better and explore potential investment opportunities to diversify your portfolio, we encourage you to consult with your financial advisor at OnePlatform Asset Management today. Discover how investment-grade bond funds can be leveraged to align with your financial goals.

#Disclaimer and Notes

Investment involves risk. Investors should carefully consider whether any investment products or services mentioned herein are appropriate for investors in view of their investment experience, objectives, financial resources and circumstances. The information is for general information and reference only and does not constitute nor is it intended to be construed as any professional advice, offer, solicitation or recommendation to deal in any of the securities or investments. OnePlatform Asset Management Limited shall not be liable for any loss or damage caused by any person’s use or misuse of any information or content, or reliance on it. Please consider to seek professional advice before making any investment decision if needed.

Fund products and portfolio management services are distributed and/or rendered by OnePlatform Asset Management Limited (a licensed corporation with SFC CE No. AFQ784).

[1] CNBC, “Here’s why Federal Reserve could cut interest rates in 2024”, 13 Feb 2024, https://www.cnbccom/select/when-will-interest-rates-drop/

[2] Yahoo!Finance, What the Fed rate decision means, 2 Feb, 2024, https://finance.yahoo.com/personal-finance/what-the-fed-rate-decision-means-for-bank-accounts-cds-loans-and-credit-cards-223702963.html

[3] US-10Y Treasury Yield vs Price, MacroMicro, 1 Aug, 2023, https://en.macromicro.me/collections/51/us-treasury-bond/761/us-10year-treasury-bond

[4] 世銀警告環球經濟今年有衰退風險, HK01, 9 January 2023, https://www.hk01.com/%E8%B2%A1%E7%B6%93%E5%BF%AB%E8%A8%8A/855133/%E4%B8%96%E9%8A%80%E8%AD%A6%E5%91%8A%E7%92%B0%E7%90%83%E7%B6%93%E6%BF%9F%E4%BB%8A%E5%B9%B4%E6%9C%89%E8%A1%B0%E9%80%80%E9%A2%A8%E9%9A%AA-%E6%96%B0%E8%88%88%E5%9C%8B%E5%AE%B6%E5%82%B5%E5%8B%99%E5%8D%B1%E6%A9%9F%E5%9A%B4%E5%B3%BB

[5] How Do Bonds Perform During a Recession? Darrow Wealth Management, 4 March 2020, https://darrowwealthmanagement.com/blog/where-can-you-hide-when-the-market-is-down/

[6] 投資級別債券 吸引力勝買股, 東方日報, 9 Jan 2023, https://hk.news.yahoo.com/%E6%8A%95%E8%B3%87%E7%B4%9A%E5%88%A5%E5%82%B5%E5%88%B8-%E5%90%B8%E5%BC%95%E5%8A%9B%E5%8B%9D%E8%B2%B7%E8%82%A1-214500871.html

[7] Federal Funds Rate vs US Bond Yield, MacroMicro, 1 Aug, https://en.macromicro.me/toolbox/chart-builder/line?chart=762

You May Be Interested In

OnePlatform Asset Management | 06 May 2024

Exploring the Potential of U.S. Equity Funds: Analyzing Factors Driving the U.S. Stock Market