Against the backdrop of the global growth slowdown, the Indian economy has stood out, with a year-on-year GDP growth of 7.6% in Q3 of 2023, making it the fastest-growing major economy. In addition, favorable factors such as India’s status as the world’s most populous country, the fastest-growing economy among G20 countries, and the world’s fifth-largest economy continue to attract investors’ high attention to the Indian market. In this article, we will delve into the reasons why Indian funds can be considered as one of the investment choices.

Understanding Indian Funds:

Indian funds provide investors with exposure to the Indian markets, enabling them to capture India’s growth potential and opportunities. The funds may invest in a range of asset classes, including stocks, bonds, money market instruments, and other financial instruments available in the Indian market. The specific investment strategy and approach of an Indian fund can vary depending on the fund’s objectives and risk profile.

Top 5 Reasons to Consider Indian Funds:

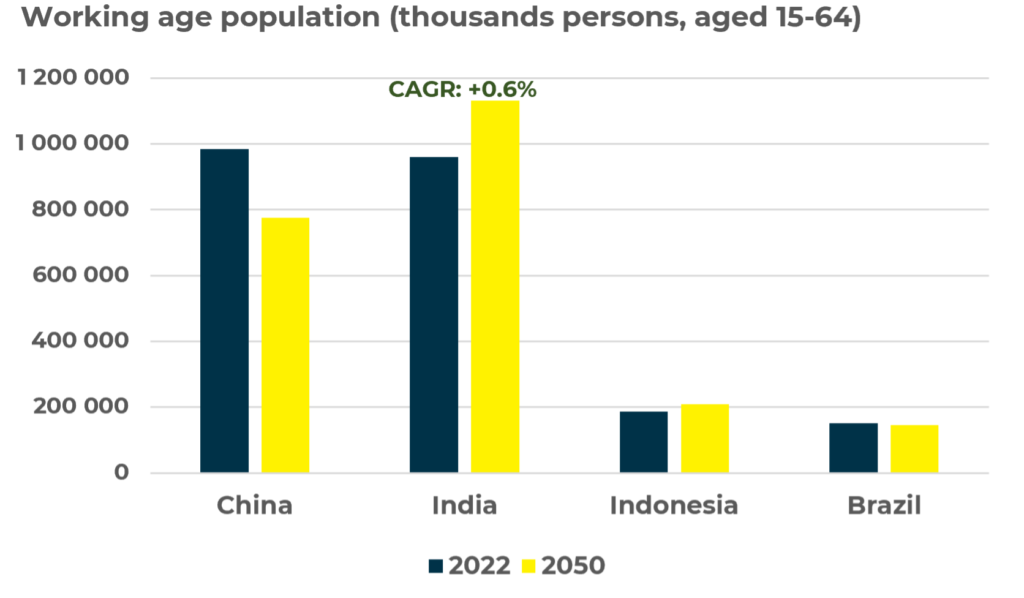

1. Strong Demographic Dividend: India’s population surpassed 1.425 billion in April 2023[1], making it the world’s most populous country. India possesses a massive demographic dividend and a rapidly growing economy, offering tremendous market potential and consumer demand. India and China have the largest work-age population in 2022. India is projected that by 2050, the Compound Annual Growth Rate (CAGR) will significantly increase by 0.6% and it is significantly higher than China. This growth is expected to be driven by the demographic dividend, promoting economic expansion. The International Monetary Fund (IMF) stated that growth in India is projected to remain strong, at 6.3% in both 2023 and 2024, surpassing that of China and the United States.

Figure 1 – The Size and Growth of India’s Working-Age Population Compared to Other Emerging Markets

Figure 2 – Economic Outlook Projections

| 2022 | 2023 | 2024 | |

| United States | 2.1% | 2.1% | 1.5% |

| Euro Area | 3.3% | 0.7% | 1.2% |

| China | 3.0% | 5.0% | 4.2% |

| India | 7.2% | 6.3% | 6.3% |

2. Potential Investment Inflow: With India’s economy experiencing sustained growth and investors are shifting their investments to the populous and expanding middle-class Indian market to mitigate geopolitical risks[3], benefiting not only the stock market but also the fixed-income market. Foreign investors have poured around USD 14 billion into the Indian stock market since the end of March 2023[4]. Indian government bonds are set to be included in GBI-EM Global Index starting in June 2024[5], acting as a catalyst for the local bond market and potentially attracting billions of dollars in funds, thus presenting significant investment opportunities.

3. The Choice of Next World’s Factory: India’s young workforce, and low labor costs, along with the Indian government’s measures to secure a larger share in the global supply chain, are attracting international companies to set up production in India. For example, Apple Inc. aims to manufacture 25% of the world’s iPhones in India within the next two to three years, and approximately 100,000 jobs are expected to be created [6]. Other renowned international automobile companies such as Nissan, Hyundai, and Volkswagen have also recently announced new plans for their business operations in India[7], creating more job opportunities for the local manufacturing industry. India is expected to become the world’s manufacturing factory by 2031 and the shift in the global supply chain has also brought better prospects to the country.

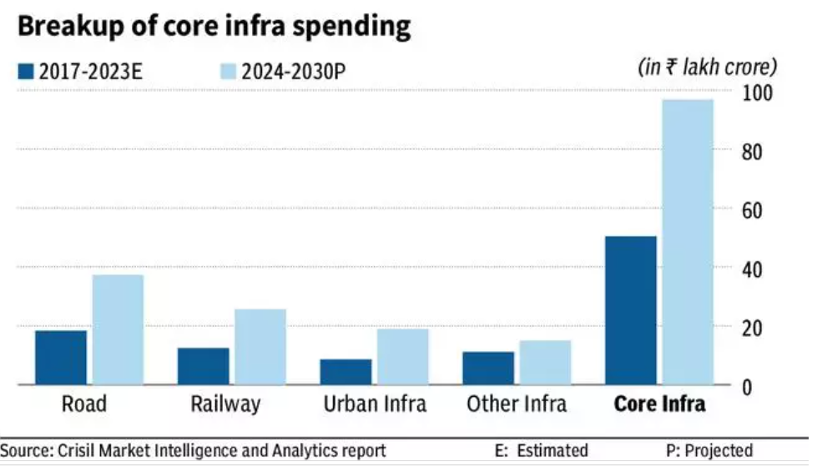

4. Progressive Infrastructure: Infrastructure is the primary limitation for foreign investors considering investment in the Indian market or business. To eliminate long-term resistance to economic development, the Indian government has increased infrastructure spending to USD 120 billion in the fiscal year 2023, marking a 37% increase from the previous year.[8] Progressive Infrastructure is expected to enhance the transportation of goods and services across state lines within India.

Figure 3 – Expected Infrastructure Spending in India

5. Positive Market Sentiment Before Election: India’s national election is expected to be held in Apr 2024. According to historical experience, the Indian index generally experiences a surge of over 10% from the pre-election. [9] The market predicts that the election effect will continue to ferment until early 2024. If Prime Minister Modi secures victory in the elections and continues to lead the government, there may be a strong likelihood that the current policies will maintain stability and continuity. Both the stock market and currency market will be expected to experience relatively strong upward movements following the election.

India is striving to harness multiple favorable factors but also faces challenges such as a high unemployment rate and persistent inflation. Despite these challenges, the strong demographic dividend, potential investment from international investors & businesses, and progressive infrastructure, along with the upcoming election reflect the attractiveness of India’s structural trends.

If you would like to understand this asset class and explore potential investment opportunities to diversify your portfolio, please talk to your financial advisor at OnePlatform Asset Management today.

#Disclaimer and Notes

Investment involves risk. Investors should carefully consider whether any investment products or services mentioned herein are appropriate for investors in view of their investment experience, objectives, financial resources and circumstances. The information is for general information and reference only and does not constitute nor is it intended to be construed as any professional advice, offer, solicitation or recommendation to deal in any of the securities or investments. OnePlatform Asset Management Limited shall not be liable for any loss or damage caused by any person’s use or misuse of any information or content, or reliance on it. Please consider to seek professional advice before making any investment decision if needed.

Fund products and portfolio management services are distributed and/or rendered by OnePlatform Asset Management Limited (a licensed corporation with SFC CE No. AFQ784).

[1] India Population, Worldometer, 20 December 2023, https://www.worldometers.info/world-population/india-population/

[2] Navigating Global Divergences, International Monetary Fund, October 2023, https://www.imf.org/en/Publications/WEO/Issues/2023/10/10/world-economic-outlook-october-2023

[3] 印度股市市值突破4兆美元,投資者湧入這個全球增長最快的經濟體, The Wall Street Journal, 8 December 2023, https://cn.wsj.com/articles/%E5%8D%B0%E5%BA%A6%E8%82%A1%E5%B8%82%E5%B8%82%E5%80%BC%E7%AA%81%E7%A0%B44%E5%85%86%E7%BE%8E%E5%85%83-%E6%8A%95%E8%B3%87%E8%80%85%E6%B9%A7%E5%85%A5%E9%80%99%E5%80%8B%E5%85%A8%E7%90%83%E5%A2%9E%E9%95%B7%E6%9C%80%E5%BF%AB%E7%9A%84%E7%B6%93%E6%BF%9F%E9%AB%94-84c0a4d9

[4] 創造歷史!印度股市首次突破67000點,外資瘋狂流, Investing.com, 20 Jul 2023, https://hk.investing.com/analysis/article-105314

[5] India’s Inclusion in JP Morgan’s Government Bond Index-Emerging Markets (GBI-EM) index is a Welcome Step, Invest India, 23 October 2023, https://www.investindia.gov.in/team-india-blogs/indias-inclusion-jp-morgans-government-bond-index-emerging-markets-gbi-em-index#:~:text=The%20announcement%20of%20India’s%20inclusion,importance%20in%20the%20world%20economy.

[6] Apple Aims to Make a Quarter of the World’s iPhones in India, The Wall Street Journal, 8 December 2023, https://www.wsj.com/tech/apple-aims-to-make-a-quarter-of-the-worlds-iphones-in-india-ab7f6342

[7] 在華遇挫後,車企尋求在印度卷土重來, The Wall Street Journal, 22 March 2023, https://cn.wsj.com/articles/%E5%9C%A8%E8%8F%AF%E9%81%87%E6%8C%AB%E5%BE%8C-%E8%BB%8A%E4%BC%81%E5%B0%8B%E6%B1%82%E5%9C%A8%E5%8D%B0%E5%BA%A6%E5%8D%B7%E5%9C%9F%E9%87%8D%E4%BE%86-85ae0c82

[8] India cuts logistics costs to below 9% of GDP with higher state spending, Reuters, 14 December 2023, https://www.reuters.com/world/india/india-cuts-logistics-costs-below-9-gdp-with-higher-state-spending-2023-12-14/#:~:text=Modi’s%20administration%20is%20spending%20of,25%20countries%2C%22%20said%20Singh.

[9] 10% rally in Nifty, Sensex? Business Today, 8 September 2023, https://www.businesstoday.in/visualstories/stock/nifty-sensex-to-rally-10-by-may-2024-due-to-general-elections-says-morgan-stanley-what-should-investors-do-with-their-portfolios-61392-08-09-2023

You May Be Interested In

OnePlatform Asset Management | 06 May 2024

Exploring the Potential of U.S. Equity Funds: Analyzing Factors Driving the U.S. Stock Market

OnePlatform Asset Management | 05 Mar 2024

Exploring the Beenfits of Investment-Grade Bond Funds in the Current Market Environment