China’s economy has been demonstrating steady performance lately, with positive indicators such as an improving Purchasing Managers’ Index (PMI), low inflation, and favorable interest rates. These developments may create a positive environment to invest in Chinese focused funds for investors seeking to capitalize on the country’s economic growth. In this article, we will explore the reasons behind investor interest in Chinese themes and the sectors they are targeting.

First, let’s examine some statistics on why investors consider now a good time to explore opportunities in China:

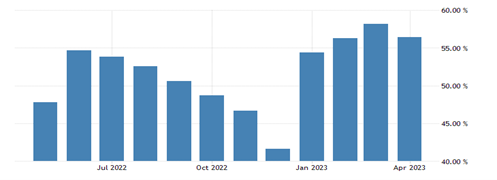

i. High non-Manufacturing PMI: China’s non-manufacturing PMI has remained above 50 in the past three months, reaching 56.4 in April 20231. This indicates growth and expansion in the service sector.

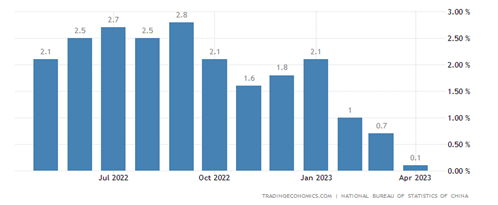

ii. Low Inflation Rate: China’s low inflation rate of 0.1% in April 20232, combined with a favorable interest rate environment, creates a conducive atmosphere for investment.

iii. Favorable Interest Rates: The People’s Bank of China announced a 25-basis point cut in the reserve requirement ratio in March 2023, aimed at easing the tight liquidity situation in the interbank market amid strong loan growth.

iv. Enormous Consumption Potential: China has a population of over 1.4 billion people, resulting in immense potential demand in its consumer market. Chinese household bank deposits reached US$38,687bn in February 2023, a 40% increase from the pre-COVID-19 level of around US$27,500bn in December 20193. As the economy restarts, China’s consumer market is expected to continue growing.

Investing in Chinese theme may present an opportunity for investors to capitalize on the country’s economic growth and achieve potential positive returns. Several sectors in China offer potential investment opportunities including:

i. Energy: Oil production cuts by some OPEC members took effect in May, and there are concerns that the supply squeeze may intensify. Some of the analysts believe OPEC may consider further output cuts in June4. These global changes in oil supply could potentially increase demand for China’s energy production.

ii. Technology & AI: Regulatory measures for the platform economy have dampened market confidence in the technology and internet industry, leading to a general decline in stock prices in 2022. However, the Chinese government has concluded investigations into major technology giants, and they have resumed user registration and received online gaming licenses. The State-owned Assets Supervision and Administration Commission (SASAC) has urged central State-owned enterprises to prioritize investment in new information technology, artificial intelligence, new energy, and other related areas. With this focus on AI and related technologies, China aims to become a leader in the global tech industry5. Market uncertainties are gradually fading, and China’s full support for 5G and AI development may help investors to revisit the current market valuation of technology-related stocks.

iii. Automobile: In 2022, the Chinese government reduced the sales tax on gasoline-powered cars in the mass market from 10% to 5% and extended the tax exemption for purchasing electric vehicles until the end of 20236. These measures are driving long-term benefits for the automobile industry to grow.

iv. Education: In July 2021, China’s education stocks were affected by a national policy easing the burden of homework and extracurricular training for students in compulsory education. In the second half of 2022, the central government adjusted the regulation of some industries, including education, to counter the economic threat posed by the worsening epidemic. At the 20th National Congress of the Communist Party of China, the focus was on reforming vocational, higher, and continuing education7. These changes have created a foundation for the turnaround of education stocks.

v. Medical: China’s aging population and rising healthcare costs create opportunities for funds to invest in the medical sector. Pharmaceutical, medical device, and healthcare service companies offer good investment prospects.

Conclusion

Investing in Chinese focused funds may present an attractive opportunity for investors seeking to capitalize on the country’s economic growth. Positive economic indicators such as the PMI, low inflation, and favorable interest rates, along with the estimated valuation of Chinese stocks, suggest that investing in funds in China could yield good returns. Additionally, several sectors in China, including energy, automobile, technology & AI, education, and medical, offer strong investment opportunities. As investors increasingly consider Chinese themes, conducting thorough research and seeking professional advice is essential for making informed investment decisions.

[1] Data from Trading Economics; [2] Data from Trading Economics; [3] Data from CEIC Data; [4] Data from Mint; [5] Data from Hong Kong Economic Journal; [6] Data from People.cn; [7] Data from gov.cn

#Disclaimer and Notes

Investment involves risk and past performance is not indicative of future performance. The content of this article is for reference only, and OnePlatform Asset Management Limited shall not be liable for any loss or damage caused by any person’s use or misuse of any information or content, or reliance on it. Please consider to seek professional advice before making any investment if needed.

Fund products and portfolio management services are distributed and/or rendered by OnePlatform Asset Management Limited (a licensed corporation with SFC CE No. AFQ784).

You May Be Interested In

OnePlatform Asset Management | 06 May 2024

Exploring the Potential of U.S. Equity Funds: Analyzing Factors Driving the U.S. Stock Market

OnePlatform Asset Management | 05 Mar 2024

Exploring the Beenfits of Investment-Grade Bond Funds in the Current Market Environment