As the market prepares for a potential rate cut by the US Federal Reserve later this year, the US dollar is likely to weaken again in the second quarter of 2024, favoring Asian assets and currency prospects. The current pause in US interest rate hikes also benefits the monetary policy of Asian markets. Asian central banks can alleviate worries regarding capital outflows resulting from US dollar appreciation and prioritize policy directions driven by local macroeconomic conditions. Asian multi-asset funds are gradually gaining attention from investors as they seek to capture the growth potential of Asian markets through diversified portfolios and risk-reduction strategies.

Understanding Asian Multi-Asset Funds:

Multi-asset funds are investment vehicles that offer a diversified approach to investing by allocating funds across multiple asset classes in Asia, including but not limited to stocks, bonds, real estate, cash, commodities, and alternative assets. It aims to spread risk and capture opportunities across different sectors and regions.

Top 4 Reasons to Consider Asian Multi-Asset Funds:

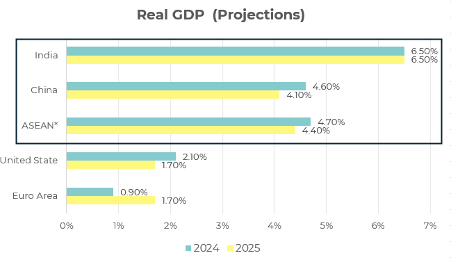

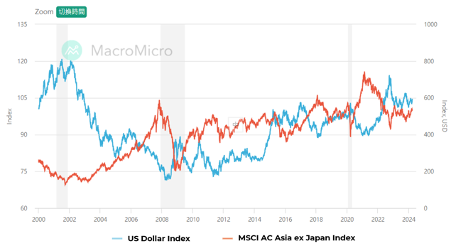

1. Weakened US Dollar Benefits Asian Stocks: The Asian region boasts higher actual Gross Domestic Product (GDP) compared to Europe andthe United States, indicating greater potential for economic growth. The expanding US fiscal deficit and current account deficit contribute to this trend. As of the end of 2023, the US federal government debt reached USD 34 trillion, with expectations for further expansion in the coming years, which puts pressure on the US dollar and benefits stock markets outside the United States[1]. Historical trends show that a weaker US dollar acts as a significant catalyst for Asian markets, leading to an upward trend in Asian stock markets when the US dollar weakens.

Figure 1 – The economic outlook for Asian countries is better than Euro Area and the United States

*ASEAN includes Indonesia, Malaysia, Philippines, Singapore, Thailand.

Figure 2 – Weakened US Dollar Benefits Asian Stocks Market

2. Resilient Asian Bonds: Despite global economic slowdown, high-interest rates, and geopolitical tensions, Asia is expected to remain the motor of the global economy this year. Asian bonds remain robust both in terms of fundamentals and strategic positioning. The widening credit spreads between Asia and Europe or America, along with relatively lower bond prices, may attract more capital inflows into Asian markets. With strong signals of rate cuts from the US Federal Reserve, investors are looking for opportunities to position themselves for an expected peak in interest rates, aiming to lock in bond yields and potentially benefit from future increases.

3. All Weather Strategy: The timing of a rebound in Asian markets and the initiation of a rate-cut cycle by the US Federal Reserve is unpredictable. Multi-asset funds employ flexible portfolio allocation strategies, ensuring an “Offensive and Defensive” approach. Fund managers adjust asset allocations based on market trends, aiming to stabilize returns and manage risks. For instance, when equities perform well, the fund can allocate a higher proportion to stocks, potentially benefiting from capital appreciation. Conversely, during periods of market downturns, the fund can shift allocations towards defensive assets like bonds or cash, aiming to preserve capital. This highlights the advantage of multi-asset funds as they can be actively managed to dynamically adjust asset allocations based on market conditions, further enhancing risk management.

4. Income Generation and Yield Enhancement: Investors not only seek higher yields but also strive for the stability of portfolio income. Asian Multi-asset Investments can help investors achieve a healthy and stable income by leveraging lower levels of volatility compared to investing in a single asset class. Some multi-asset funds may distribute dividends regularly, with yields potentially exceeding 6%, making them relatively attractive in future rate-cut cycles.

Overall, the fundamentals in Asia are favorable for asset markets, enabling Asian multi-asset funds can provide investors with the benefits of diversification, risk management, and income generation. By allocating across multiple asset classes and employing flexible strategies, these funds offer a balanced approach to investing. As no single investment consistently outperforms others across all market conditions, multi-asset funds can serve as a valuable tool for achieving more stable returns through risk diversification.

If you would like to understand this asset class and explore potential investment opportunities to diversify your portfolio, please talk to your financial advisor at OnePlatform Asset Management today.

#Disclaimer and Notes

Investment involves risk. Investors should carefully consider whether any investment products or services mentioned herein are appropriate for investors in view of their investment experience, objectives, financial resources and circumstances. The information is for general information and reference only and does not constitute nor is it intended to be construed as any professional advice, offer, solicitation or recommendation to deal in any of the securities or investments. OnePlatform Asset Management Limited shall not be liable for any loss or damage caused by any person’s use or misuse of any information or content, or reliance on it. Please consider to seek professional advice before making any investment decision if needed.

Fund products and portfolio management services are distributed and/or rendered by OnePlatform Asset Management Limited (a licensed corporation with SFC CE No. AFQ784).

[1] US national debt hits record $34 trillion, CNN, 3 January 2024, https://edition.cnn.com/2024/01/03/economy/us-national-debt-34-trillion/index.html

You May Be Interested In

OnePlatform Asset Management | 05 Mar 2024

Exploring the Beenfits of Investment-Grade Bond Funds in the Current Market Environment